Navigating the latest ALTA best practices, real estate regulations, and conferences can be overwhelming. The challenges of managing transactions, ensuring compliance, and mitigating risks is work enough. Not to mention the added pressure of safeguarding your customers’ trust and protecting sensitive data!

There was one more thing added to your plate – the new American Land Title Association (ALTA) best practices that were implemented in May of 2023. While title companies with an ALTA certification are current for 24 months, it’s recommended that they start adhering to these new practices ASAP.

But it’s one thing to say a title company will start following these new best practices and another to follow through.

As an IT managed service provider (MSP) specializing in the title industry, we understand these challenges. Our team stays ‘in the know’ of the latest title industry trends and regulations, particularly those set forth by the ALTA.

We bring our experience below to help steer your business towards compliance with the new, more technical ALTA best practices. In this article, we will delve into three approaches to help you comply:

- Protect against digital fraud

- Train your team against cyber threats

- Prioritize customer data & security

By the end of this piece, you will gain a deeper understanding of these ALTA best practices and how to implement them. Are you ready to help your title company become more secure and compliant?

ALTA Best Practice #1: Protect Against Fraud

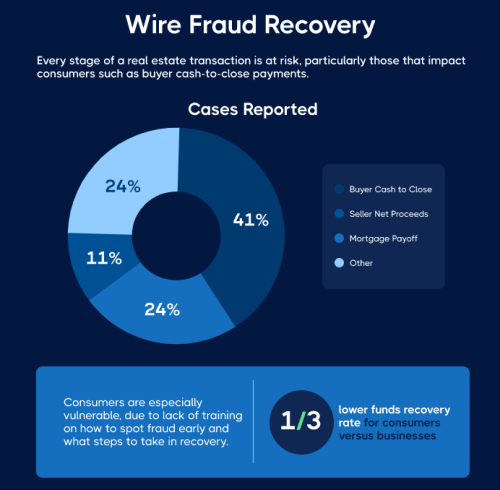

In May of 2023 alone, CertifID customers caught 18 fraud attempts, totaling $4 million! It’s no surprise that the revised best practices included changes to the use of wire verification services.

Title companies need to be more aware when it comes to protecting against fraud. Fraud can manifest in various forms, such as identity theft, forged documents, and cybercrimes that lead to wire fraud.

As a best practice, ALTA recommends adopting a proactive approach to preventing fraud. But how can you actually do that?

Title companies can implement identity verification procedures to avoid dealing with impostors. By ensuring that every party in a transaction is who they claim to be, businesses can protect themselves and their clients from potential losses.

Watch this ALTA webinar on the state of wire fraud in the title industry!

The quality control process for reviewing documents should be rigorous as well. Look out for discrepancies or unusual patterns in transactions that might suggest foul play. Using advanced document verification can help, as they detect forged signatures or altered documents.

Specific cybersecurity measures also play a vital role in preventing wire fraud. Here is a list of actions you can take to get started:

- Implement a mandatory call to verify policy

- Use security hardened systems, networks, and computers

- Educate your clients about phishing scams

- Use secure email services

Remember, being wary of fraud is not a one-time effort, but an ongoing commitment. Regularly updating your security measures in line with the latest ALTA best practices is crucial.

By doing so, you’ll not only protect your business, but also build trust with your clients by demonstrating that their security is a top priority!

ALTA Best Practice #2: Train Your Team Against Cyber Threats

While using proper system protections against fraud is important, fostering a cyber-aware culture is too. Every team member, from the receptionist to the CEO, plays an essential role in safeguarding your digital assets.

Your team must understand how to identify and react to threats like phishing emails, BEC schemes, ransomware attacks, etc.

However, training shouldn’t be limited to generic cybersecurity principles. It should also include user training on popular title industry software, like SoftPro, Qualia, and RamQuest.

These platforms hold vast amounts of sensitive information. Employees need to understand the security features these platforms offer, how to use them appropriately, and how to report potential security issues.

Tip: Don’t forget to update your software regularly!

With a cyber-savvy workforce and even cybersecurity technology solutions, your title company can create a first line of defense against cyber threats. Besides helping your team comply with ALTA best practices, you’ll also reduce the risk of data breaches.

ALTA Best Practice #3: Prioritize Customer Privacy and Data Security

As the latest ALTA best practices states, it’s essential for title companies to protect non-public information. You can do this by:

- Implementing secure data storage solutions

- Employing encrypted communications when dealing with clients or third parties

- Ensuring that all paper documents with personal information are securely stored or disposed of

Even simple steps can greatly reduce the risk of a data breach. Regular audits and assessments can help to identify weaknesses in your security infrastructure.

By adhering to these steps, title companies maintain the trust of their customers, comply with ALTA best practices, and prevent future legal issues.

Conclusion: Is Your Title Company Ready to Prepare For The New ALTA Best Practices?

While you work on complying with the new ALTA standards for re-certification, you’ll also be improving your general security. Keep in mind that the strategies we shared above are ongoing processes that will need to be periodically reviewed.

Navigating new trends and requirements in the title industry is not easy. In this article, we’ve highlighted three approaches to comply with ALTA best practices:

- Being wary of fraud

- Fostering a cyber-savvy workforce

- Prioritizing customer privacy and data security.

We encourage you to learn how we can help you stay up-to-date with the latest ALTA’s best practices. With Premier One, you can ensure that your title company continues to thrive and is ready for whatever challenges come next.